NC GAS-1274A 2021-2026 free printable template

Show details

Web-Fill

9-21

GAS-1274A

4

?

PRINT

CLEAR

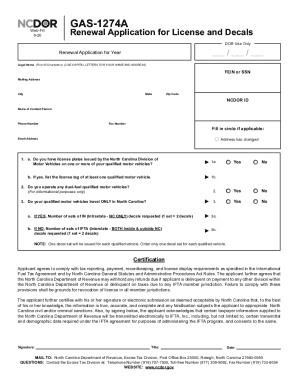

Renewal Application for License and Decals

DOR Use Only

Renewal Application for Year

Legal Name (First 35 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

FEIN or SSN

Mailing Address

City

State

Zip Code

NCDOR ID

Name of Contact Person

Phone Number

Fax Number

Fill in circle if applicable:

Address has changed

Email Address

1. a. Do you have license plates issued by the North Carolina Division of

Motor Vehicles on one or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form gas 1274 a renewal

Edit your gas 1274a renewal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gas 1274a form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gas 1274a renewal online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pdffiller form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC GAS-1274A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out gas 1274a fillable form

How to fill out NC GAS-1274A

01

Title Section: Fill in the title of the form at the top.

02

Personal Information: Enter your name, address, and contact information in the designated fields.

03

Description of Goods: Provide a detailed description of the goods involved in the transaction.

04

Dates: Include relevant dates, such as the date of purchase or transaction.

05

Signatures: Ensure all required parties sign the form where indicated.

06

Review: Double-check all entered information for accuracy before submitting.

Who needs NC GAS-1274A?

01

Those involved in the sale or transfer of goods in North Carolina.

02

Businesses or individuals who require documentation for tax or regulatory purposes.

03

Anyone needing to provide proof of goods for legal or financial reasons.

Fill

north carolina ifta renewal

: Try Risk Free

People Also Ask about gas 1274a renewal application

How much federal tax is in a gallon of gasoline?

The federal government levies taxes on gasoline (18.4 cents a gallon) and diesel (24.4 cents a gallon). These tax rates have been unchanged since 1993.

How much tax is on a gallon of gas in NC?

The state income tax rate for 2022 is 4.99%. That drops to 4.75% for 2023, and the plan is to keep enacting small cuts until the rate hits 3.99% in 2027. It's a flat rate, so everyone who owes state income taxes pays on the same rate, regardless of income. The state gas tax now is 38.5 cents a gallon.

What are the requirements for IFTA in NC?

1. Who Is Required To Register for North Carolina IFTA? Two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or 11,797 kilograms; or. Having three or more axles regardless of weight; or.

Do I need a NC fuel sticker?

Fuel decals are required for any single licensed vehicle having three (3) or more axles (regardless of weight) or any licensed vehicle having a registered weight OR actual weight of over 26,000 pounds, single vehicle or combined (trailer, etc.).

Why is N.C. gas tax so high?

The state's gas tax increased by 2 cents from 38.5 cents to 40.5 cents. This new number takes into account the increase in population and inflation. The gas tax in North Carolina is the state's largest funding source for road projects.

Where can I get NC tax forms?

To download forms from this website, go to NC Individual Income Tax Forms. To order forms, call 1-877-252-3052. Touch tone callers may order forms 24 hours a day, seven days a week. You may also obtain forms from a service center or from our Order Forms page.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ncdor gas 1274a renewal directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form gas 1274 a as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit gas 1274 form in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your gas 1274a, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete gas 1274 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your nc gas 1274a renewal by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is NC GAS-1274A?

NC GAS-1274A is a form used to report North Carolina state and local government financial data.

Who is required to file NC GAS-1274A?

Local governments in North Carolina, including counties, municipalities, and certain authorities, are required to file NC GAS-1274A to comply with state financial reporting requirements.

How to fill out NC GAS-1274A?

To fill out NC GAS-1274A, gather relevant financial data from your financial statements, follow the instructions provided in the form guidelines, and input the required information in each section accurately.

What is the purpose of NC GAS-1274A?

The purpose of NC GAS-1274A is to ensure transparency and accountability in the financial activities of local governments in North Carolina by providing a standardized reporting framework.

What information must be reported on NC GAS-1274A?

Information that must be reported on NC GAS-1274A includes financial statements, revenue sources, expenditures, and liabilities specific to the local government entity.

Fill out your NC GAS-1274A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nc Ifta Renewal is not the form you're looking for?Search for another form here.

Keywords relevant to nc fuel sticker renewal online

Related to nc fuel stickers

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.